AR DWS-ARK-209B 2009-2026 free printable template

Show details

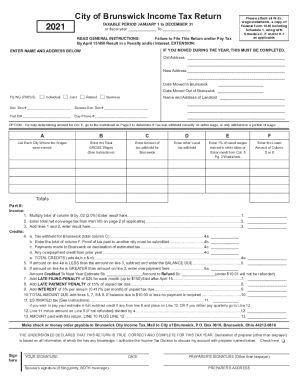

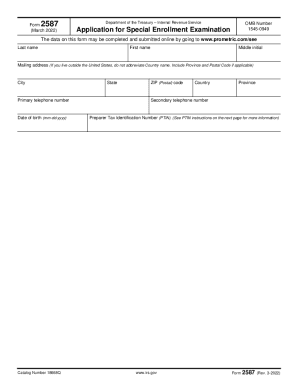

OF EMPLOYEES ON THIS REPORT TOTAL WAGES FOR THIS PAGE TOTAL WAGES PAID. I HEREBY CERTIFY THIS REPORT IS TRUE AND CORRECT AND NO PARTS OF THE CONTRIBUTION HAVE OR WILL BE BORNE BY ANY EMPLOYEE. SIGNATURE TITLE DATE TELEPHONE DWS-ARK-209B REV. NAICS AUD CO EMPLOYER S QUARTERLY CONTRIBUTION AND WAGE REPORT ARKANSAS DEPARTMENT OF WORKFORCE SERVICES P. O. BOX 8007 LITTLE ROCK ARKANSAS 72203-8007 501 682-3798 DWS ID NUMBER DATE QUARTER ENDED FEDERAL ID NUMBER REPORT DUE DATE Check box and return if...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dws ark 209b online form

Edit your dws ark 209b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer quarterly contribution report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit arkansas wage report online online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit dws ark 209b quarterly contribution form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out arkansas form dws ark 209b

How to fill out AR DWS-ARK-209B

01

Gather necessary personal information, including your name, address, and social security number.

02

Provide details of your employment history, including dates of employment and employer information.

03

Describe the reasons for your unemployment or the nature of your earnings if self-employed.

04

Answer any questions regarding your eligibility for unemployment benefits honestly and completely.

05

Review the form for any required signatures or dates.

06

Submit the form as instructed, either online or via mail.

Who needs AR DWS-ARK-209B?

01

Individuals who have recently become unemployed and are seeking unemployment benefits in Arkansas.

02

Self-employed individuals who are applying for pandemic-related unemployment assistance.

03

Workers looking to confirm their eligibility for financial assistance during unemployment.

Fill

arkansas quarterly report form

: Try Risk Free

People Also Ask about arkansas dws ark 209b

What is an AR941A form?

File Form AR941A. File AR941, Employers Annual Report for Income Tax Withheld and pay any tax due for the previous calendar year.

What is an AR W 3?

A Form ARW-3 Transmittal is completed when state copies of Forms W-2, Wage and Tax Statement, are being filed. Do not file Form ARW-3 alone. Use a Form ARW-3 even if only one Form W-2 is being filed. Make sure both the Form ARW-3 and Forms W-2 show the correct tax year and Federal Employer IdentificationNumber (FEIN).

What is the extension form for Arkansas withholding?

If you want to file specifically for a State of Arkansas Extension, you must file Arkansas form AR1055. This form must be postmarked on or before April 15.

How do I pay my payroll taxes in Arkansas?

In Arkansas, you will need to register with the Department of Finance and Administration (DFA) to process payroll and remit business taxes. You can register with the DFA either online through the Arkansas Taxpayer Access Point or by mail using Form AR-1R.

Is Arkansas a mandatory withholding state?

An employer is required to withhold tax from wages of employees who work within the State of Arkansas. An employer is not required to withhold Arkansas tax from the wages of any employee who does not work within the state of Arkansas. However, the employee's wages are still taxable.

What is AR941PT?

ar941pt. AR941PT Pass-Through Entity Withholding Report INSTRUCTIONS This form is used to report the tax withheld on nonresident members of a pass through entity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the dws arkansas login electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your dws ark 209b blank in seconds.

How can I edit ar quarterly contribution wage report on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing arkansas contribution wage report, you need to install and log in to the app.

How do I fill out arkansas quarterly wage report pdf using my mobile device?

Use the pdfFiller mobile app to fill out and sign state quarterly wage report. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is AR DWS-ARK-209B?

AR DWS-ARK-209B is a specific form used for reporting certain employment-related data in the state of Arkansas.

Who is required to file AR DWS-ARK-209B?

Employers operating in Arkansas who have employees or independent contractors are required to file AR DWS-ARK-209B.

How to fill out AR DWS-ARK-209B?

To fill out AR DWS-ARK-209B, follow the instructions provided on the form, ensuring that all required fields are completed accurately, including employer information, employee details, and employment dates.

What is the purpose of AR DWS-ARK-209B?

The purpose of AR DWS-ARK-209B is to facilitate the reporting of employment data necessary for compliance with state workforce regulations and programs.

What information must be reported on AR DWS-ARK-209B?

The information that must be reported on AR DWS-ARK-209B includes employer identification details, employee names, Social Security numbers, and employment start and end dates.

Fill out your AR DWS-ARK-209B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

The Purpose Of Ar Dws Ark 209b Is To Facilitate Get Started Now is not the form you're looking for?Search for another form here.

Keywords relevant to arkansas quarterly report

Related to ar report form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.